Uranium tops Morgan Stanley’s commodity thermometer

While the DRC is not currently exploiting or marketing its uranium ores, this American investment bank advises its clients to bet on this strategic metal which has the most upward trend possible on the international market among the 17 commodities. of the mining industry right now around the world.

Morgan Stanley has placed uranium at the top of its barometer for metals and mining commodities. Uranium has been assigned a “most bullish” trend of 17 commodities mined under the bank’s watch, mining.com reports.

“Further price increases in the near term, as commercial stocks decline, investment demand continues and mining supply remains below 2019 levels. Longer term, growth continues to push prices up,” reads -on in a slide shared by a social media user.

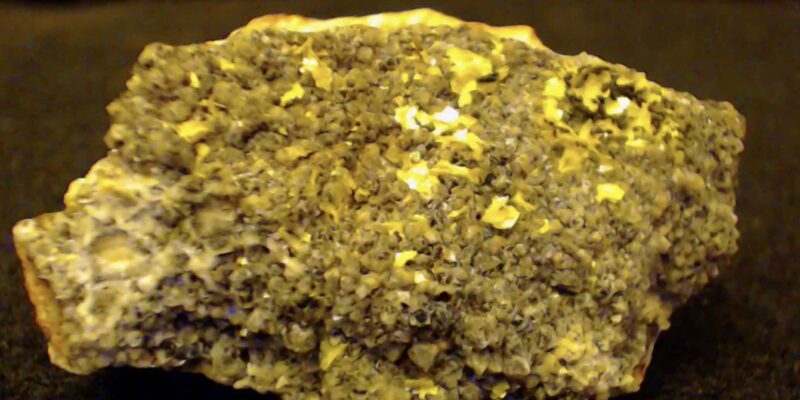

With reserves of around a century, uranium is the most widely used fissile element in nuclear power plants. Its use is very important in the energy mix of certain countries. This makes it a raw material whose control can prove to be strategic.

Global uranium production amounted to around 60,500 tonnes in 2015, divided mainly between Kazakhstan (39%), Canada (22%), Australia (9%), Niger (7 %), Russia (5%), Namibia (5%) and Uzbekistan (4%). For its use in nuclear reactors, the resources recoverable at a cost of less than 130 dollars / kg of uranium were estimated in 2014 by the IAEA at 5.9 million tonnes worldwide, distributed mainly between Australia (29% ), Kazakhstan (12%), Russia (9%) and Canada (8%).

Morgan Stanley is an investment bank headquartered in New York City. A listed company on the New York Stock Exchange, this investment bank was founded in 1935. Morgan Stanley helps individuals, businesses and institutions create, preserve and manage their wealth so they can pursue their financial goals.

This financial institution has global expertise in market analysis and advisory and capital raising services for businesses, institutions and governments. It offers active investment strategies on the public and private markets and personalized solutions for institutional and individual investors.

![]()